What is an Auto Insurance Endorsement?

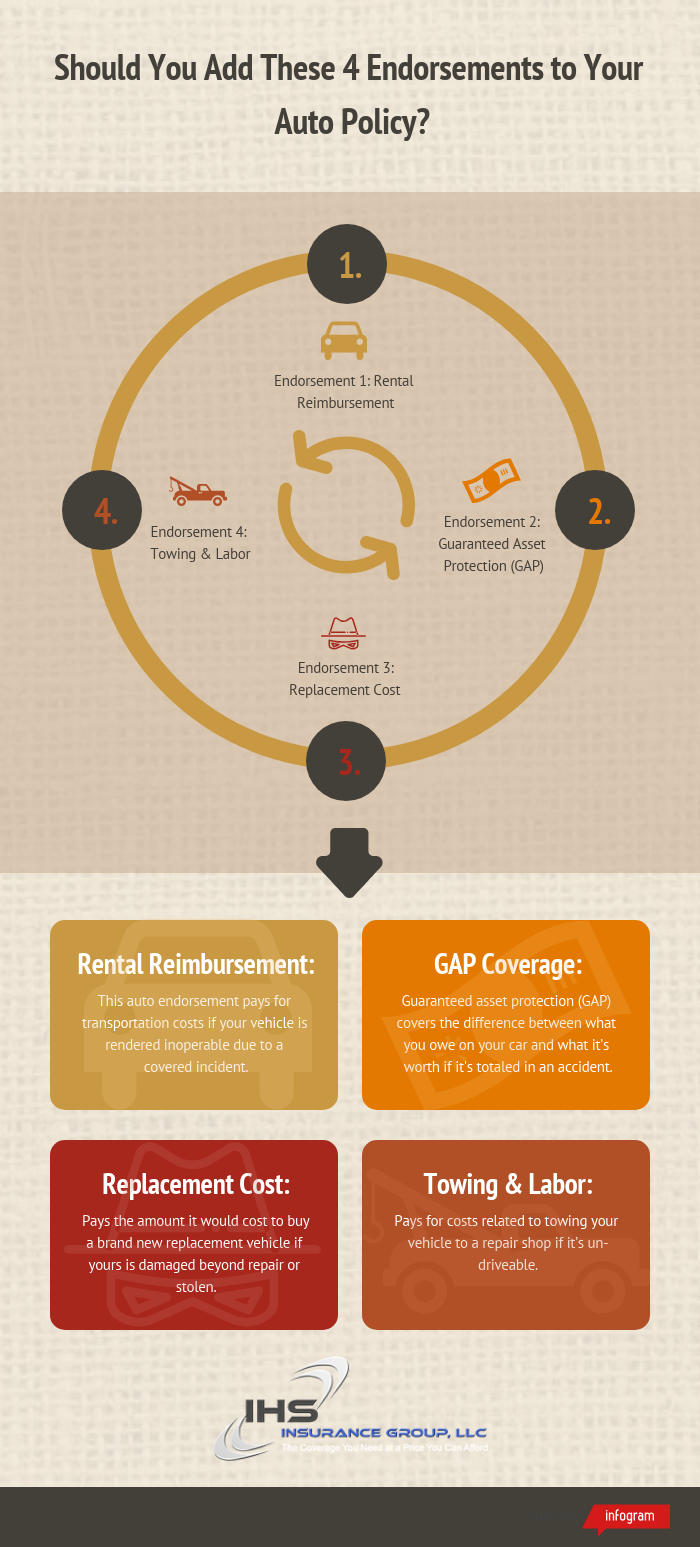

An ‘endorsement’ changes coverage under your auto policy, compared to its original or existing state.

In other words, whether you need to add or remove a vehicle or driver, increase or decreaseimits or deductibles, or alter coverage in just about any way, an ‘endorsement’ is simply a fancy word for making an optional change to your policy.

Endorsements aren’t unique to auto, though, since they also allow you to make changes to other personal lines policies, including home, personal articles floaters, umbrellas, and watercraft.

In this article, the IHS Insurance Group team will quickly focus on four of the most common auto endorsements, and how you can decide which ones you need.

How Does Rental Reimbursement Work?

What happens if you’re involved in an accident, and you don’t have a way to get to work while the shop repairs your vehicle? Enter rental reimbursement endorsements.

Also commonly referred to as “rental car coverage” or “transportation expense coverage,” rental reimbursement helps pay not just for transportation expenses such as rental vehicles (obviously), but also public transit fare. However, rental reimbursement coverage does not kick in if your car breaks down due to mechanical failure.

Your auto policy typically displays your rental reimbursement coverage as split limits: e.g., 25/750. In this example, the endorsement would cover transportation costs up to $25 per day, with a $750 limit per claim.

IHS Pro Tip: If you drive a vehicle with a higher replacement cost (more soon), you’ll want to choose higher rental reimbursement limits so that you can drive a similar car while yours is being repaired.

Otherwise, you’ll have to pay the difference or downgrade your rental options.

Most of the carriers IHS Insurance Group represents offer rental reimbursement coverage at affordable rates, typically less than $15 additional per month, depending on the limits chosen.

What’s the Deal with Guaranteed Asset Protection (GAP) Coverage?

If you lease or finance your vehicle and it’s deemed a total loss after an accident (or following a theft), Guaranteed Asset Protection, abbreviated as GAP, helps cover the difference between what you owe on your car and what it’s worth.

For example, you recently purchased a new vehicle and financed a total of $25,000. After regularly commuting for several months, you’re involved in a severe accident that leaves your car totaled.

Upon factoring in wear-and-tear and depreciation (otherwise known as Actual Cash Value (ACV)), your insurance company determines that your car is valued at $20,000. Unfortunately, you still carry a loan balance of $22,500.

Without GAP coverage on your auto policy, you’d be responsible for the remaining $2,500, plus your standard policy deductible. On the other hand, adding a GAP endorsement before an accident could save you from some hefty out-of-pocket expenses.

Despite its potential usefulness, the Insurance Information Institute reports GAP coverage only costs about $20, annually, to add to your auto policy. Depending on the carrier, though, they may have strict stipulations in place, especially when it comes to your vehicle’s age.

Is it Valuable to Add a Replacement Cost Coverage Endorsement?

Actual cash value takes into account the car’s cost new, minus depreciation (otherwise known as current market value). On the other hand, a replacement-cost endorsement changes a policy so that it pays the amount it would cost to buy a brand new replacement vehicle if yours is damaged or stolen.

Bottom line: A replacement cost endorsement means that your insurance company will pay the vehicle’s original price, regardless of how old or used it was at the time of loss.

A carrier’s guidelines are typically stricter when it comes to replacement cost coverage eligibility, compared to GAP. Common factors include:

- Vehicle age, often three years or newer

- Mileage, e.g., 15,000 or less

- Vehicle ownership, such as having been purchased within the last year

Companies also charge a wide variety of rates for replacement cost coverage, based on factors like your vehicle, its value (before and after depreciation), its likelihood of being totaled, your driving record, its garaging location, and how the company’s filed with the state.

As a general rule of thumb, though, you can estimate about a five percent premium increase after adding a replacement cost coverage endorsement to your policy.

Should You Add a Towing and Labor Coverage Endorsement?

Similar to replacement cost and GAP, the coverage provided under towing and labor endorsements can vary a great deal between carriers.

In general, though, they pay for costs related to towing your vehicle to a repair shop if it’s un-drivable. The endorsement can also cover additional related charges at the breakdown site like:

- Changing a tire

- Delivering gas, oil, and water

- Attending to your battery, including jumpstarting

- Regaining access after locking yourself out

Most carriers only offer towing and labor on vehicles that already carry physical damage coverage, such as comprehensive and collision.

Related: What Is Comprehensive Auto Insurance?

It’s also important to keep in mind that towing and labor endorsements don’t typically cover the cost of parts needed to repair your vehicle, nor the associated labor to install them. Furthermore, unlike liability coverage, towing and labor only applies to one vehicle on your policy and doesn’t follow when you’re behind the wheel of another car.

How Can You Learn Which Auto Endorsements Your Policy Needs?

Whether you’re looking for additional information about towing and labor, rental reimbursement, GAP, replacement cost coverage, or any other auto endorsement, you can turn to the professional staff at IHS Insurance Group.

Currently, we’re licensed for auto (as well as other personal lines policies) in TX and TN.

Need a FREE Quote or have questions regarding Automobile Insurance Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063.

- If you prefer to fill out a quick form and have an agent get back with you at your convenience, use the GET A FREE QUOTE.

- Lastly, for those that want an immediate quote, please click HERE.

We look forward to speaking with you today!