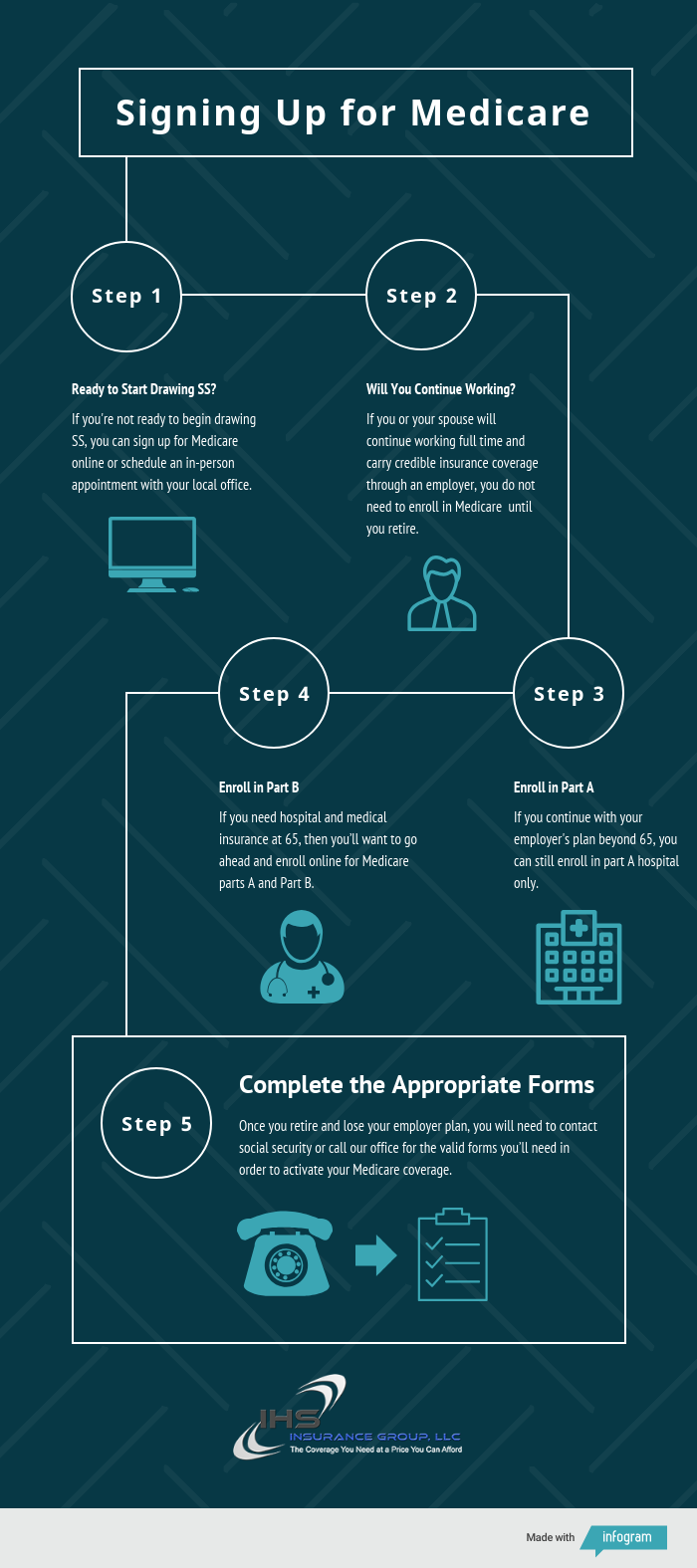

5 Steps for Enrolling in Medicare

Enrolling in Medicare in order to access health benefits may seem like a chore. But, it is fairly easy once you know where to go and when you will need to enroll. Plus, there are a number of ways to enroll based on your preferred method.

Step 1: Determine if You’re Ready to Start Drawing Social Security

If you’re within 90 days of your 65th birthday or older and not ready to begin drawing your social security benefits or spousal benefits you can always use The Social Security Administration’s web portal to enroll in Medicare only.

Click here to be directed to the online application: https://secure.ssa.gov/iClaim/rib Or, you can schedule an appointment at your local social security office within 90 days of your 65th birthday.

Step 2: Decide If You’ll Remain Under Your Employer’s Plan

If you or a spouse plan to continue working full time and decide to carry your employer plan, you will not enroll under Medicare part B until you retire and your group benefits cease.

It is very important to enroll in Medicare at 65 if you do not have employer insurance or some other type of credible insurance coverage. Delaying your Medicare enrollment can cost you thousands in penalties over your lifetime depending on how long you delay so, it is a good idea to proactively begin the process of enrollment well in advance of your qualification date, which is usually the first day of the month in which you turn 65.

Step 3: Enroll in Part A

Medicare Part A hospital insurance does not carry a premium and is usually free to any eligible Medicare beneficiary who has worked a minimum of 40 quarters.

If you plan to continue accessing your employer plan beyond 65 you can still enroll online or in person for part A hospital only. This will not affect your future eligibility under Medicare supplement, part D, or Medicare part B so long as you are working full time and carrying group insurance.

Step 4: Enroll in Part B

Medicare part B is your medical insurance through Medicare and usually carries with it a monthly plan premium similar to private insurance. If you need hospital and medical insurance at 65, then you’ll want to go ahead and enroll online for Medicare part A and Part B.

If you are delaying social security payments beyond 65 then the Social Security administration will enroll you in A and B. Then they will subsequently send you a statement for the part B premium with a number of payment options associated with it.

Once you finally begin taking social security, your part B premium will then be automatically withheld from your payment each month in lieu of a mailed statement. You can legally defer part B as long as you or a spouse works full time and carries the employer insurance. There will be no penalties for late enrollment so long as you maintain this credible health insurance through your employer.

Step 5: Complete the Appropriate Forms Upon Retirement

Once you retire and lose your employer plan you will need to contact social security or call our office for the valid forms you’ll need in order to activate Medicare part B for the first time. One form is for your employer’s HR department to complete and the other form you’ll need to complete. You can drop these forms by your local social security office or mail them in.

Once social security activates your part B medical insurance you are officially enrolled and can now select a Medicare Supplement plan along with a standalone part D or Medicare Advantage plan under your open enrollment provision.

You will not be required to answer health questions on the Medicare Supplement application and cannot be denied for coverage within 6 months of your part B effective date. Your agent or broker can request an effective date which coincides with your part B date or your employer’s termination date, whichever comes first.

Do You Need to Know More About Enrolling in Medicare?

If you need assistance with any of these issues or would like us to email you the appropriate part B enrollment forms, please complete a contact form on our website or call us at 281-255-4444 your convenience.

You can also fill out our Get Quote form. We will be happy to guide you every step of the way, making it easy for you to enroll in Medicare and your supplemental insurance plans.