Key Details About Medicare Part B

At just 20 percent, Medicare Part B provides significantly less overall coverage than Part A. However, it also picks up two critical benefits excluded under part A:

- Medically necessary services – Treatments used to address or diagnose your condition, and that also “meet accepted standards of medical practice.”

- Preventative services – Those that help you prevent or detect early illnesses (i.e., the flu).

Another important distinction is that unlike Part A, which is managed by the federal government, you must purchase Part B supplement plans through a private insurance carrier. This is where the professionals at IHS Insurance can help!

We’ll walk you through the process several months before your 65th birthday, to ensure that your Part B plan begins the same day as your Part A coverage. There’s no open enrollment period, so you can change your plan as soon as you’re approved.

Let’s quickly discuss other critical aspects of Medicare Part B coverage and how it can affect you.

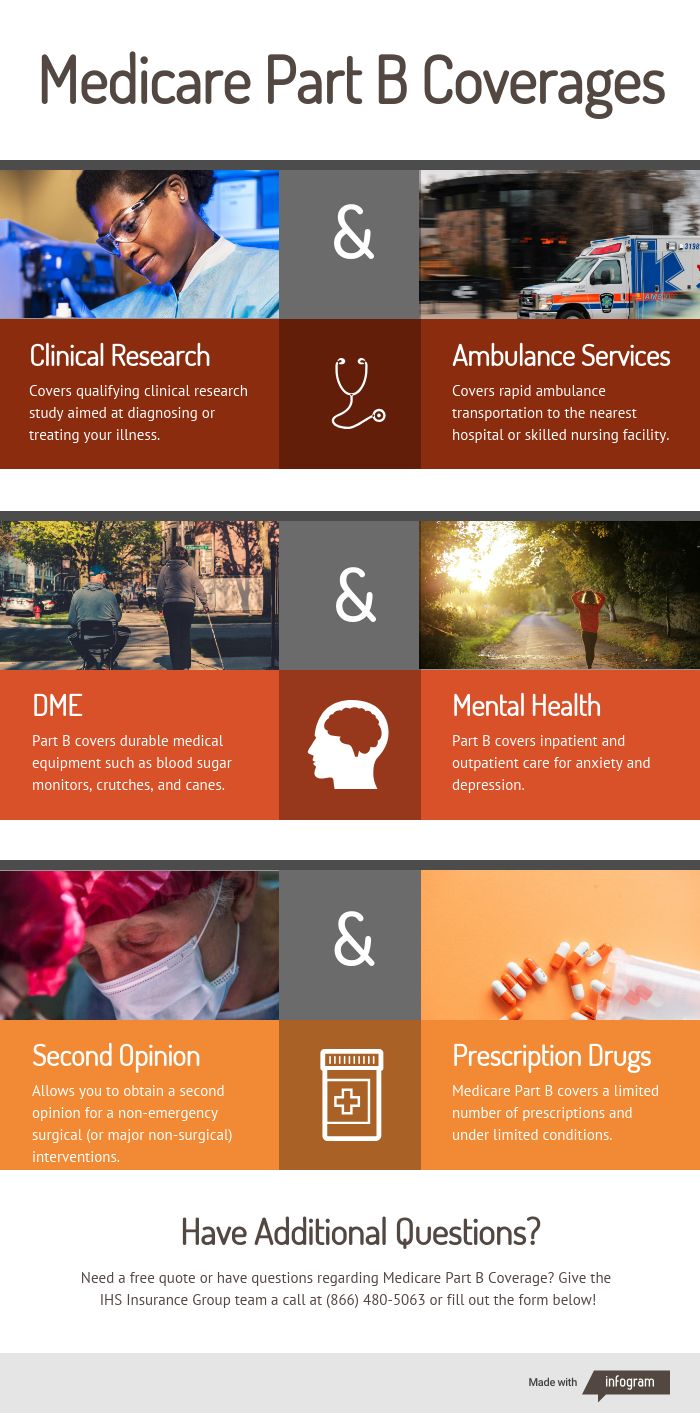

Which Coverage Does Medicare Part B Provide?

Keep in mind there are three core stipulations that Medicare abides by when determining whether or not a specific claim is covered, including federal and state laws, as well as a medical necessity.

If you have questions about specific services or supplies, Medicare recommends talking with your healthcare provider or searching their coverage website.

Now, let’s take a high-level look at coverage provided under Medicare Part B.

Does Medicare Part B Cover Clinical Research?

If you’re considering joining a qualifying clinical research study aimed at diagnosing or treating your illness, Medicare Part B could cover costs related to office visits and tests.

However, you may still be responsible for up to 20 percent of the Medicare-approved amount, along with your Part B deductible.

Is There Coverage For Ambulance Services?

If you 1) require medically necessary services, 2) must be transported to the nearest hospital or skilled nursing facility (SNF) to receive them, and 3) doing so via any other vehicle might endanger your health, Medicare may cover emergency ground transportation in an ambulance.

If rapid ambulance transportation can’t provide immediate assistance, coverage could extend to a helicopter or airplane.

You’re still responsible for 20 percent of the approved amount and your Part B deductible.

Is Durable Medical Equipment (DME) Covered Under Part B?

Medicare Part B covers durable medical equipment that you need to rent or buy for a medical reason in your home, isn’t used someone who isn’t sick or injured, and “generally has an expected lifetime of at least three years.” As such, only your Medicare-enrolled doctor can prescribe DME.

Examples (not a complete list) include blood sugar monitors and test strips, canes, crutches, hospital beds, oxygen equipment, walkers, and wheelchairs and scooters.

IHS Pro Tip: Before you purchase durable medical equipment, make sure to ask your suppliers if they participate in Medicare. Otherwise, you may be charged directly.

Typically, you’ll pay your regular Part B deductible, along with 20 percent of the Medicare-approved amount.

Mental Health: Is It Covered Under Medicare Part B?

If you have depression or anxiety (as just a couple of common examples), Medicare Part B may provide additional coverage on top of Part A for inpatient, outpatient, and partial hospitalization mental health services.

Keep in mind, however, they must be received “in a general hospital or a psychiatric hospital that only cares for people with mental health conditions.” Also, there’s no coverage for private duty nursing an in-room phone or TV, personal items (e.g., toothpaste, socks, razors, etc.), or a private room unless deemed medically necessary by your physician.

If You Need a Second Opinion Before Surgery, Will Medicare Cover?

If you have a non-emergency situation where your doctor prescribes surgical (or major non-surgical) intervention to diagnose or treat your health problem, Medicare Part B may cover payment if you choose to seek a second opinion.

If the first and second opinions differ, they’ll even help pay for a third opinion.

Does Medicare Part B Provide Limited Coverage For Outpatient Prescription Drugs?

If you’re prescribed medication at a doctor’s office, in a hospital outpatient setting, or at a pharmacy, Medicare Part B may cover “a limited number” and “under limited conditions.” This is also if they’re not covered under Part D .

These include (not an exhaustive list) those used with durable medical equipment, doctored-prepared antigens, injectable osteoporosis drugs, other infused drugs, blood clotting factors, and some medications used to treat end-stage renal disease.

Medicare Part B won’t cover the entire amount, though, since you’re responsible for 20 percent of the total.

We’ll carry this thought over to the next section.

What Can You Expect to Pay For Your 2019 Medicare Part B Premium?

Although what you’ll pay depends on several factors like other insurance you have, the amount your doctor charges, and the type of facility where you receive treatment, the table below can give you a high-level idea under Medicare Part B.

| How Much Will Your Medicare Part B Coverage Cost? | ||

| Coverage | Out of Pocket Expenses | Notes |

| Clinical Research | Varies based on your condition, the specific study, and the treatments received | You may be responsible for up to 20 percent of the Medicare-approved amount, along with your Part B deductible. |

| Ambulance Services | Varies depending on transportation need and type | Must be an emergency. You may be responsible for up to 20 percent of the Medicare-approved amount, along with your Part B deductible. |

| Durable Medical Equipment (DME) | Varies based on the type of equipment, diagnosis, and whether you need to rent or buy | Medically necessary equipment only. You may be responsible for up to 20 percent of the Medicare-approved amount, along with your Part B deductible. |

| Mental Health | $1,364 deductible per benefit period; $0 coinsurance per first 60 days; $341 coinsurance per day 61–90 days; $682 coinsurance per day for 91+ days up to lifetime reserve | Lifetime reserve of 190 days. No coverage for private duty nursing, in-room phone/TV, or personal items (e.g., toothpaste, socks, razors, etc.), or a private room. |

| Surgical Second Opinion | Varies depending on the procedure | You’ll pay 20 percent of the Medicare-approved amount for second and third opinions, plus your Part B deductible. |

| Outpatient Prescriptions | Varies based on your diagnosis, the medication prescribed, and if it’s covered under Part D . If none of the above apply, you’ll pay 100 percent. | You may be responsible for up to 20 percent of the Medicare-approved amount, along with your Part B deductible. |

How Can You Learn More About Your Medicare Part B Coverage?

The professional team at IHS Insurance has decades of combined experience helping clients like you learn more about their Medicare coverage, whether related to Part B or anything else.

Need a FREE Quote or have questions regarding Medicare Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063.

- If you prefer to fill out a quick form and have an agent get back with you at your convenience, use the GET A FREE QUOTE.

- Lastly, for those that want an immediate quote, please click HERE.