Best Medicare Supplement Plans in the State of Texas

As of 2018, there were about 3.9 million Medicare enrollees in the state of Texas, with more than 750,000 of these individuals choosing to seek additional coverage through a third-party Medigap plan.

In this article, the professional team at IHS Insurance Group will walk you through some of the top Medigap plans that we believe will meet most peoples’ needs. From there, we’ll let you know how to find out more information when it’s time to enroll.

The Basics: Texas Medigap Coverage

All 10 Medigap insurance plans sold in Texas, lettered A through N, feature the same core criteria. This means each one:

- Allows you to choose any doctor who participates in Medicare, at any time

- Doesn’t require referrals

- Guarantees renewal, which means that your coverage cannot be canceled based on a health condition you develop

However, not all carriers offer every Medigap plan. This means that one company could provide access to all ten, while another might only offer a single one.

And even if a company offers a plan you’re interested in (more next), this doesn’t necessarily mean you’ll meet their underwriting criteria for eligibility.

And if you do, one company’s premium could be much higher than another, depending on unique factors like the area of Texas in which you live, your age, and whether or not you purchased a plan during open enrollment.

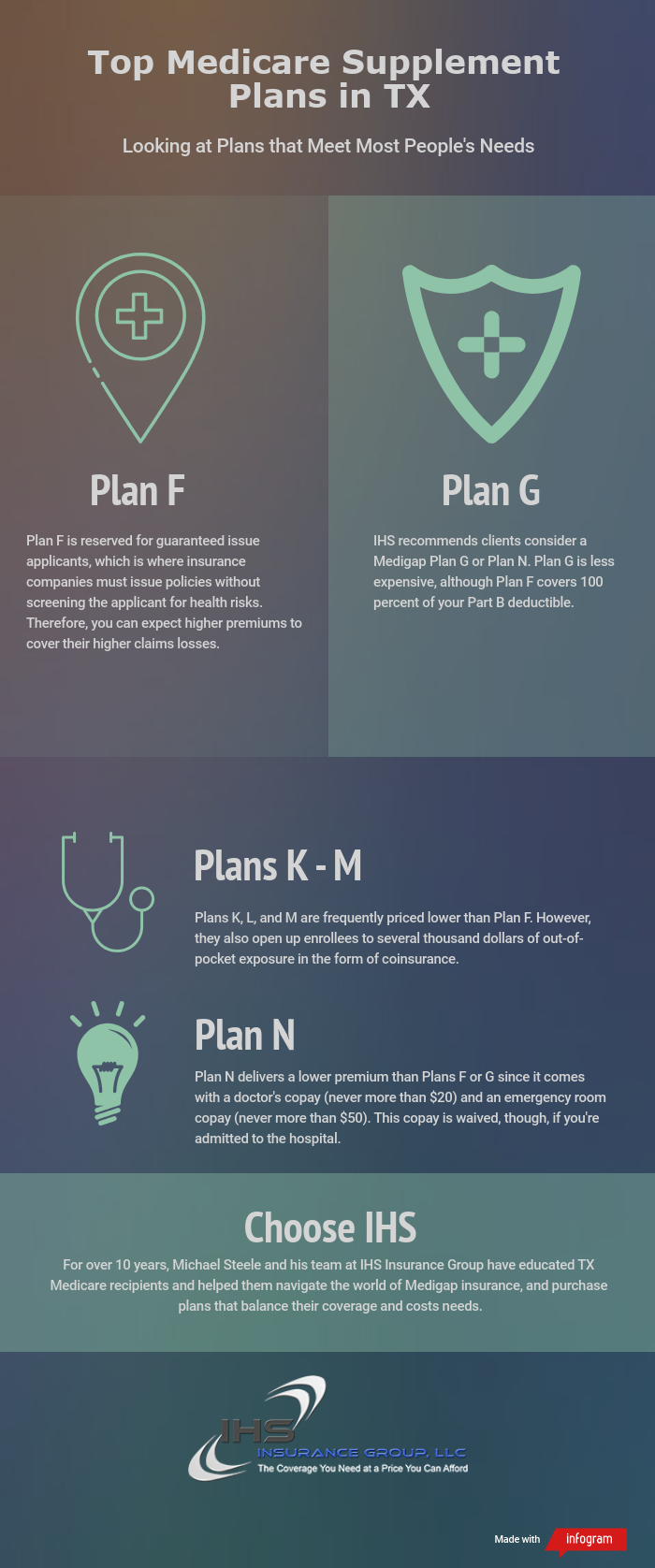

Is Medigap’s Plan F the Best For Texas Residents?

The reality is that, like most other types of health insurance, it’s unlikely that any Medigap plan will perfectly balance your coverage needs, as well as your budget.

However, while Medigap’s Plan F has traditionally been the most popular among Texas residents and non-residents alike, Michael Steele, Principal Owner of IHS Insurance Group and Certified Financial Planner, emphasizes, “I never recommend Plan F as a viable purchase option for a Medicare supplement.” Why?

These plans are “reserved for guaranteed issue applicants, which is where insurance companies must issue policies without screening the applicant for health risks,” he explains. Therefore, you can expect “higher premiums to cover their higher claims losses.”

Important note: According to the Medicare.gov website, Plan F (as well as Plan C) is no longer available to individuals who newly enroll in Medicare as of January 1, 2020.

Michael explains that the decisions you make around your Medigap plan are crucial, and could impact you for the rest of your life, for two core reasons.

First, once you’ve signed up for a Medicare supplement policy, it’s a guaranteed renewable contract, which means you can never be canceled. However, if your health status changes and you switch to another company to save money, it may be impossible for you to do so.

Second, “if you buy a Plan F and the rates jump to $400 or $500 per month several years down the road, you might not be able to change out from under it,” Michael says.

Advice: Texas Medigap Enrollees Should Consider Plans G or N

Instead of a Plan F, Michael recommends to many of his clients that they consider a Medigap Plan G or Plan N.

Plan G Differences

Michael explains this is because “Plan G is identical to Plan F, except for one negligible difference: whereas Plan F covers 100 percent of your Part B deductible ($183 for 2020), Plan G does not.”

“However, Plan G’s premium is commonly $300 to $500 less than the Plan F,” Michael notes, “thereby potentially saving you several hundred dollars over the course of a year.”

What About Plans K–M?

From a premium perspective, Plans K, L, and M are frequently priced lower than Plan F. However, they also open up enrollees to several thousand dollars of out-of-pocket exposure in the form of coinsurance.

That “defeats the purpose, in my opinion, of buying a Medicare supplement, which is designed to cover you effectively in the event of an emergency,” Michael advises.

Plan N Distinctions

Finally, Plan N delivers a lower premium than Plans F or G.

It accomplishes this by adding two copays that Plan G Plan automatically covers:

Doctor’s copays, which never exceed $20, and emergency room copays, which are no more than $50. What’s more, this ER copay is waived if you’re admitted to the hospital, even if for only one night.

Another important distinction, according to Michael, is that Plan N doesn’t have coverage available for any Medicare Part B excess charges. What’s this mean for you?

“In a nutshell,” Michael explains, “if a provider is not on Medicare Assignment, that provider can legally charge an excess of the Medicare-approved amount, as much as 15 percent.”

Here’s a quick table outlining the key differences between Medigap Plans F, G, and N:

| Medigap Benefits | Medigap Plans | ||

| F | G | N | |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up | Yes | Yes | Yes |

| Part B coinsurance or copayment | Yes | Yes | Yes |

| Blood (first 3 pints) | Yes | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes |

| Skilled nursing facility care coinsurance | Yes | Yes | Yes |

| Part A deductible | Yes | Yes | Yes |

| Part B deductible | Yes | No | No |

| Part B excess charge | Yes | Yes | No |

| Foreign travel exchange (up to plan limits) | 80% | 80% | 80% |

| Out-of-pocket limit in 2020 | N/A | N/A | N/A |

Credit: Medicare.gov

Choosing Between Texas Medigap Plans

As we frequently discuss in our articles, the “best” insurance for you is based on a thorough examination of your needs, and then balancing them with your preferences.

But, Michael warns that “no Medigap plan is perfect,” and there’s no one right choice to make across the board.

“For example,” he says,” some people like the idea of paying a little less every month for a Plan N, and they’re willing to take on a little more exposure in the form of copays and potential excess charges.”

On the other hand, “for an extra 10 to 15 percent in premium, some people feel better eliminating doctor’s copays and their Part B excess exposure, and just paying their annual Part B deductible.”

Michael ends with the following advice: “In my professional opinion, the Plan G represents a sweet spot in Medicare insurance for Texas enrollees.”

Attention Texas Residents: Trust the Medigap Insurance Professionals

For over 10 years, Michael Steele and his team at IHS Insurance Group have educated TX Medicare recipients and helped them navigate the world of Medigap insurance, and purchase plans that balance their coverage and costs needs.

Need a FREE Quote or have questions regarding Medicare or Medigap Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063.

- If you prefer to fill out a quick form and have an agent get back with you at your convenience, use the GET A FREE QUOTE.

- Lastly, for those that want an immediate quote, please click HERE.

Also, check out our Medicare FAQ’s here.