What is Open Enrollment for Medicare?

Because enrollment in Medicare is limited to certain times of the year, it’s essential to mark your calendar – and make sure that you’re as informed as possible. That’s precisely what I’ll help you accomplish in this article.

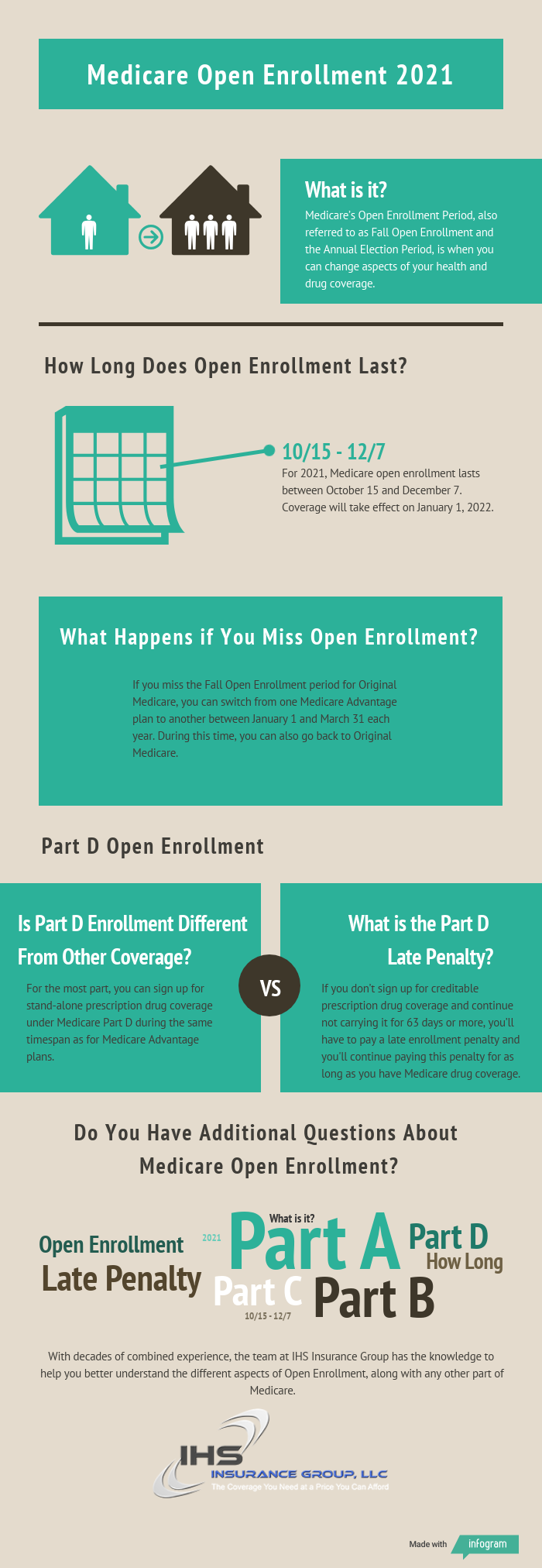

Medicare’s Open Enrollment Period, also referred to as Fall Open Enrollment and the Annual Election Period, is when you can change aspects of your health and drug coverage.

Related: How You Can Easily Enroll in Medicare

When is it?

When is Open Enrollment and How Long Does it Last?

For 2021, Medicare open enrollment lasts between October 15 and December 7. Any changes you make, including joining, switching, or dropping a plan, will take effect on January 1, 2022. Keep in mind that your plan must receive your request by December 7.

Related: When Can I Change My Medicare Plan?

Will you get in trouble if you miss the Fall Open Enrollment Period?

What Happens if You Miss the Open Enrollment Period?

If you miss the Fall Open Enrollment period for Original Medicare, you can switch from one Medicare Advantage plan to another between January 1 and March 31 each year. During this time, you can also go back to Original Medicare.

Let’s carry this thought over to the next question.

What is the Medicare Advantage Plan Open Enrollment?

As mentioned earlier, you can switch between one Medicare Advantage plan and another between January 1 and March 31 every year. You can also drop your Medicare Advantage plan and return to Original Medicare.

Related: Medicare Part C Coverage Basics

However, there are several extenuating circumstances in which you can also make changes:

- You move.

- You’re eligible for Medicaid.

- You qualify for Extra Help with Medicare drug costs.

- You’re receiving care from a skilled nursing facility or

- long‑term care hospital.

- You want to switch to a plan with a five-star-rated quality rating.

What about prescription drug coverage?

Is Medicare Part D Open Enrollment Different From Other Coverage?

For the most part, you can sign up for stand-alone prescription drug coverage under Medicare Part D during the same timespan as for Medicare Advantage plans. You can also:

- Change from one stand-alone drug plan to another

- Drop your Advantage Plan and return to Part D coverage under Original Medicare

Related: What Coverage Does Medicare Part D Provide?

Before moving on, let’s briefly talk about the Part D late penalty.

How Does the Part D Late Penalty Work?

If you don’t sign up for creditable prescription drug coverage and continue not carrying it for 63 days or more, you’ll have to pay a late enrollment penalty that’s attached to your premium. It’s critical to emphasize that you’ll generally have to pay this penalty for as long as you have Medicare drug coverage.

Related: 4 Potential Part D Pitfalls and How to Avoid Them

Do You Have Additional Questions About Medicare Open Enrollment?

With decades of combined experience, the team at IHS Insurance Group has the knowledge to help you better understand the different aspects of Open Enrollment, along with any other part of Medicare.

Need a FREE Quote or have questions regarding Medicare Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063.

- If you prefer to fill out a quick form and have an agent get back to you at your convenience, use the GET A FREE QUOTE.

- Lastly, for those that want an immediate quote, please click HERE.

Also, check out our Medicare FAQs here.