How to Select the Best Medigap Plan for You

Because Medicare standardizes all Medigap policies, the fact of the matter is that you will receive the same level of lettered-plan coverage, regardless of the insurance company you choose.

In other words, purchasing a Plan N from Company XYZ, for example, would provide you with the exact same coverage as if you bought it from Company ABC.

As a result, choosing a Medigap plan isn’t rocket science – as long as you’re informed with a few basics. That’s precisely what we’ll cover in this article.

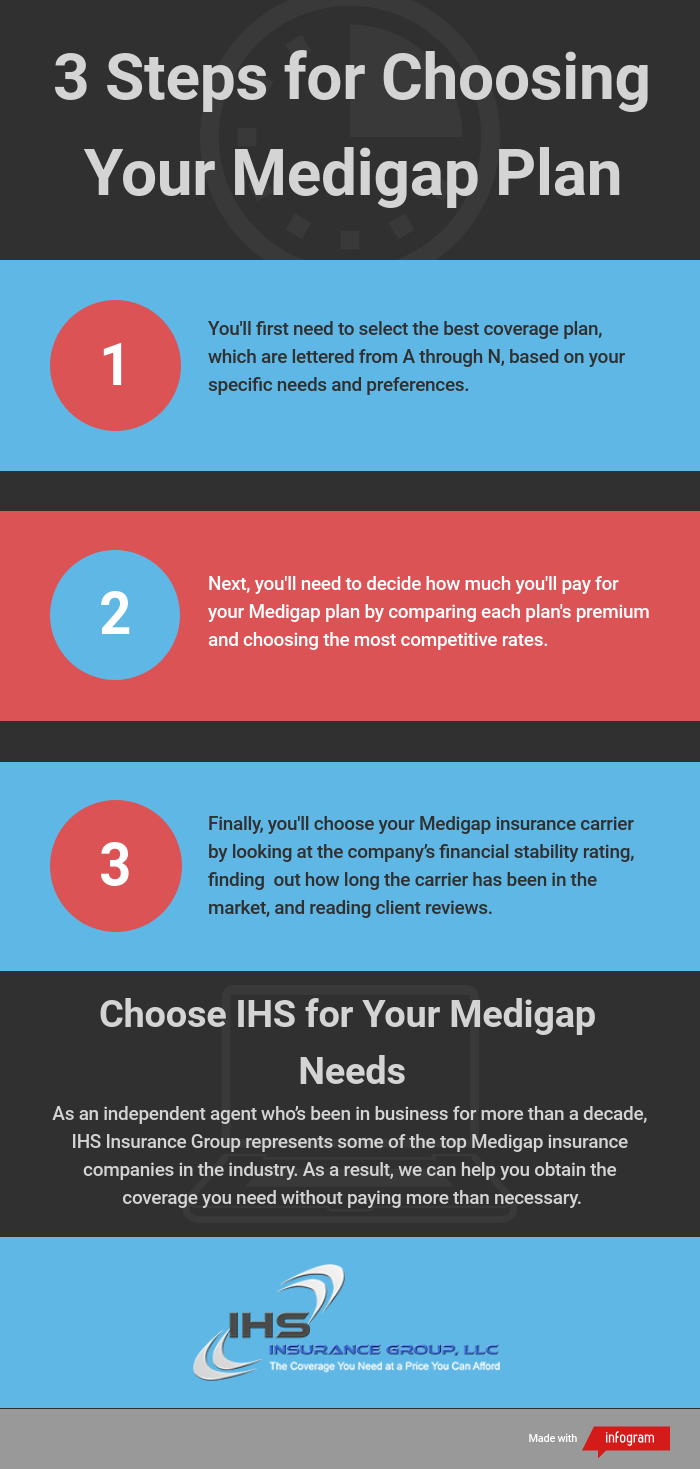

Over the next few minutes, the team at IHS Insurance Group will outline three core criteria that you should keep at the top of your mind when choosing Medicare Supplement (Medigap) insurance. Let’s start with step one.

1. Selecting a Medigap Coverage Plan

Medigap plans are lettered A – N2, each offering a different set of coverages. The chart below, taken from the Medicare.gov website, quickly outlines several of their essential distinctions:

| Medigap Benefits | Medigap Plans | |||||||||

| A | B | C | D | F* | G* | K | L | M | N | |

| Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Part B coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes*** |

| Blood (first 3 pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A hospice care coinsurance or copayment | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled nursing facility care coinsurance | No | No | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Part A deductible | No | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Part B deductible | No | No | Yes | No | Yes | No | No | No | No | No |

| Part B excess charge | No | No | No | No | Yes | Yes | No | No | No | No |

| Foreign travel exchange (up to plan limits) | No | No | 80% | 80% | 80% | 80% | No | No | 80% | 80% |

| Out-of-pocket limit in 2020** | N/A | N/A | N/A | N/A | N/A | N/A | $5,880 | $2,940 | N/A | N/A |

With these details in mind, your first step when buying Medigap insurance is to choose a plan that matches your specific combination of needs and preferences.

For example, Plan L has the highest Part A deductible and the second-highest out-of-pocket expenses. And Plan K’s out-of-pocket costs are nearly twice as high as Plan L’s!

IHS Pro Tip: If you became eligible for Medicare after January 1, 2020, you can no longer choose Plans C or F above.

Furthermore, some plans include emergency medical benefits when traveling to foreign countries, which might be vital if you plan to become a globetrotter during your golden years.

Related: 8 Questions to Help You Choose Your Best Medicare Plan

2. Deciding How Much to Pay For Your Medigap Plan

Remember, Medicare standardizes all available Medigap plans. Given this, once you’ve selected your best coverage option, the next step is as easy as learning which insurance carriers offer the most competitive rates.

In other words, Company A might charge much higher premiums—sometimes hundreds of dollars more per month—for your Plan N (as an example) than Company B, based on their specific underwriting criteria. And with no differences in coverage between them!

IHS Pro Tip: Multiple factors can impact your overall Medigap premium, including your age, the state in which you live, whether or not you signed up during open enrollment, and even current inflation.

Related: How Do Special Medicare Enrollment Periods Work?

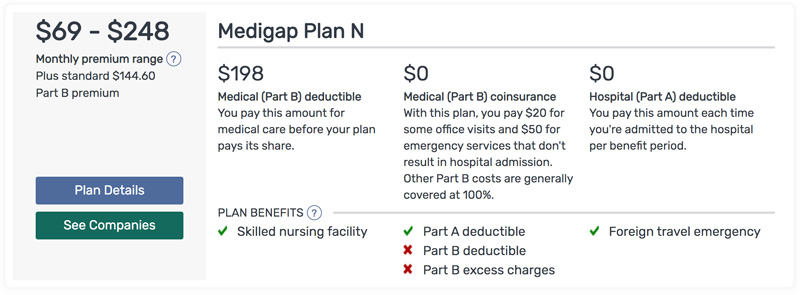

Like any other health insurance, Medigap plans can differ significantly in the price: anywhere from around $20 per month to well over $300. Fortunately, Medicare.gov’s Find a Medigap Policy Tool is a super-handy way to quickly find plans in your area, which groups listings by:

- Attained Age Pricing – The older you are, the more you pay.

- Community Pricing – What you pay can be impacted by factors other than age.

- Unknown Pricing – Companies have not reported their pricing methods.

From there, the Medicare website displays each plan’s monthly premium range, deductibles, and benefits. You can click on each one to learn more, as well as view companies offering the plan in your area.

3. Choosing Your Medigap Insurance Carrier

Once you’ve decided which Medigap plan provides you with the best coverage, your third, and final, step is to choose an insurance carrier.

An excellent place to start is by taking a look at the company’s financial stability rating, which is graded (e.g., A+, A-, etc.). AM Best and Demotech are two great resources that you can quickly search for this information.

Next, find out how long the insurance carrier has been in the Medigap market. While a company’s length of time in business—by itself—shouldn’t make or break your decision, choosing a company with a decades-long track record of success could be reassuring.

Last, but certainly not least, find out what other policyholders are saying about their experiences with the company. This could speak volumes about what you might experience after signing on the dotted line.

IHS Pro Tip: Pay especially close attention to what clients are saying about their customer service experiences, as this department is the conduit between you and the company when you have questions or concerns.

Bottom Line: IHS Insurance Group is Here to Help You Choose Your Best Medigap Plan

As an independent agent who’s been in business for more than a decade, IHS Insurance Group represents some of the top Medigap insurance companies in the industry. As a result, we can help you obtain the coverage you need without paying more than necessary.

After all, choosing a Medigap plan is a decision that shouldn’t be taken lightly.

Need a FREE Quote or have questions regarding Medicare or Medigap Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063

- If you prefer to fill out a quick form and have an agent get back with you at your convenience, use the GET A FREE QUOTE

- Lastly, for those that want an immediate quote, please click HERE

Also, check out our Medicare FAQ’s here.