Important Details About Medicare

Medicare is a federal social program designed to assist older and disabled individuals with their insurance costs.

How Does Medicare Work?

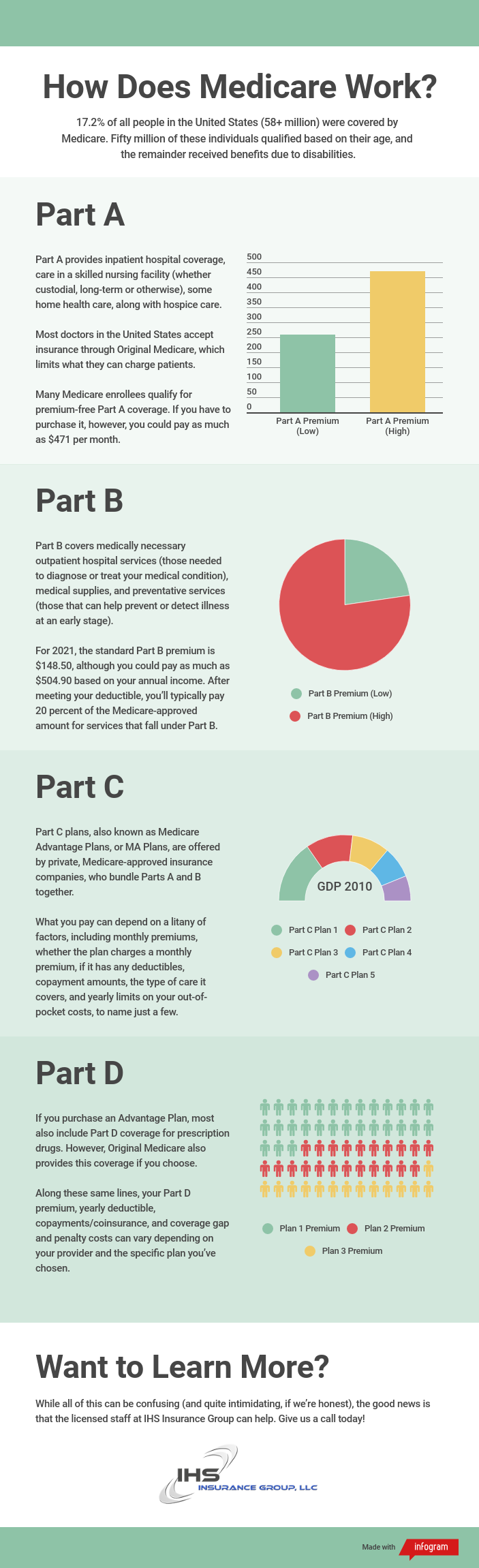

According to Statista, as of 2017, 17.2 percent of all people in the United States (58+ million) were covered by Medicare. Fifty million of these individuals qualified based on their age, and the remainder received benefits due to disabilities.

The federal government spent $707 billion supporting the Medicare program this same year, which amount to about 3.5 percent of the United States’ gross domestic product.

The vast financial resources allocated to this critical social program aside, how does it work? We’ll quickly explain the basics here.

Before diving in, though, keep in mind that Medicare coverage is dependent on three main factors:

- Federal and state laws.

- National coverage decisions made by Medicare about whether something is covered.

- Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Now, let’s begin.

Medicare is made up of four main sections, each of which is designated by a letter.

Medicare Part A

Part A is a portion of Original Medicare, the federal government’s direct insurance program. It provides inpatient hospital coverage, care in a skilled nursing facility (whether custodial, long-term or otherwise), some home health care, along with hospice care.

Most doctors in the United States accept insurance through Original Medicare, which limits what they can charge patients.

Many Medicare enrollees qualify for premium-free Part A coverage. If you have to purchase it, however, you could pay as much as $458 per month.

Medicare Part B

Part B is also part of Original Medicare, which offers coverage for medically necessary outpatient hospital services (those needed to diagnose or treat your medical condition), medical supplies, and preventative services (those that can help prevent or detect illness at an early stage).

Other examples of services covered under Medicare Part B include clinical research, ambulance services, durable medical equipment (DME), mental health services, and a limited number of outpatient prescription drugs (we’ll discuss medication soon).

For 2020, the standard Part B premium is $144.60, although you could pay as much as $491.60 based on your annual income. After meeting your deductible, you’ll typically pay 20 percent of the Medicare-approved amount for services that fall under Part B.

Medicare Part C Advantage Plans

Now’s the point at which we depart from Original Medicare.

Part C plans, also known as Medicare Advantage Plans, or MA Plans, are offered by private, Medicare-approved insurance companies, who bundle Parts A and B together. Some of the most common plans include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Private Fee-For-Service (PFFS).

Part C plans must provide the same benefits offered by Original Medicare. However, many also include Part D coverage (more next), as well as extra coverage for vision, hearing, and/or dental services. Keep in mind that Part C plans may also come with different rules and restrictions than Original Medicare.

Related: Medicare Supplement Insurance Plans Explained

The Medicare.gov website also explains that, although “Medicare pays a fixed amount for your care each month to the companies offering Advantage Plans,” each plan can charge the enrollee (i.e., you) different out-of-pocket costs.

What you pay can depend on a litany of factors, including monthly premiums, whether the plan charges a monthly premium, if it has any deductibles, copayment amounts, the type of care it covers, and yearly limits on your out-of-pocket costs, to name just a few.

Medicare Part D

If you purchase an Advantage Plan, most also include Part D coverage for prescription drugs. However, Original Medicare also provides this coverage if you choose.

As with Part C, Medicare sets a standard level of coverage provided under Part D, although third-party providers frequently cover different lists of prescription medications (known as formularies).

Along these same lines, your Part D premium, yearly deductible, copayments/coinsurance, and coverage gap and penalty costs can vary depending on your provider and the specific plan you’ve chosen.

Would You Like to Know More About How Medicare Works?

After reading all of this information, are you wondering if Original Medicare is right for you, or if you should choose an all-in-one Advantage Plan? And if you want the latter, how can you decide between the best providers and their different plans?

While all of this can be confusing (and quite intimidating, if we’re honest), the good news is that the licensed staff at IHS Insurance Group can help.

Need a FREE Quote or have questions regarding Medicare Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063.

- If you prefer to fill out a quick form and have an agent get back with you at your convenience, use the GET A FREE QUOTE.

- Lastly, for those that want an immediate quote, please click HERE.

Also, check out our Medicare FAQ’s here.