What Will You Pay for Medicare?

How much your Medicare plan will cost is one of the top questions the IHS Insurance staff receive. In this article, I’ll briefly simplify the costs and outline precisely what you need to know before handing over your hard-earned money.

Let’s start from the beginning with Part A.

Part A Premium

The Medicare.gov website explains that most people don’t pay a monthly premium for Part A. So long as you’ve worked 40 quarters and paid taxes into the system, you will not have a premium.However, if you choose to purchase coverage, it will cost you up to $471 per month, depending on the number of quarters you paid Medicare taxes:

- Less than 30 quarters: $471

- 30 to 39 quarters: $259

With this said, you’ll also have to pay a $1,484 deductible for each benefit period and between $0 and $742 coinsurance, depending on the timetable:

- $1,484 deductible for each benefit period

- Days 1-60: $0

- Days 61-90: $371

- Days 91+: $742

- Beyond lifetime reserve: all costs

Here are the Part A costs if you purchased coverage through Original Medicare:

| Home Health Care | $0. You’ll also pay 20% of the Medicare-approved amount for Durable Medical Equipment (DME) |

| Hospice Care | $0. You may need to pay a copay of no more than $5 for prescriptions and other pain relief measures. Remember that you may also have to pay 5% of the approved amount for inpatient respite care. Medicare does not cover room and board for hospice care. |

| Inpatient Hospital Stay | $1,484 deductible for each benefit period. You also pay between $40 and $742 coinsurance, depending on your length of stay. It’s important to emphasize that Medicare only pays for a private room unless it’s medically necessary. You’ll also have to pay for “private-duty nursing, a television, or a phone in your room.” |

| Mental Health Inpatient Stay | $1,484 deductible for each benefit period. You’ll also pay between $0 and $742 coinsurance, depending on the length of your stay. Medicare also covers 20% of the approved amount for doctor-based mental health services while you’re an inpatient. |

| Skilled Nursing Facility Stay | Between $0 and $185.50 coinsurance, depending on the length of your stay. |

Keep in mind that these are Medicare’s standard expenses. If you don’t purchase coverage when you’re first eligible, for example, you could pay a 10% rate increase, which you’ll continue paying “for twice the number of years you could have had Part A, but didn’t sign up.”

Part B Premium

What you’ll pay for your Medicare Part B premium largely depends on your income prior to enrolling:

- If your filed income was between $88K (individually) and $176K (jointly), you’ll pay $148.50 per month.

- If your filed income was between $111K (individually) and $222K (jointly), you’ll pay $207.90 per month.

- If your filed income was between $138K (individually) and $276K (jointly), you’ll pay $297 per month.

- If your filed income was between $165K (individually) and $330K (jointly), you’ll pay $386.10 per month.

- If your filed income was between $165K and $500K (individually), or $330K to $550K (jointly), you’ll pay $475.20 per month.

- If your filed income was above $500K (individually) or $750K (jointly), you’ll pay $504.90 per month.

As with Part A, these are Part B’s standard costs. If you fail to enroll in Part B when you’re eligible, you’ll also pay a 10% penalty on your premiums.

Related: The Basics About Medicare Part B Coverage

Your annual Part B deductible for 2021 is $203, after which you’ll usually pay 20% of the approved costs for most doctor’s services, outpatient therapy, durable medical equipment (DME), clinical laboratory services, and home health services.

It’s a similar situation with outpatient mental health services. You don’t pay anything for yearly depression screenings, although outside of this, you’ll pay 20% of the approved amount for hospital or clinic inpatient or outpatient services.

Part C Premium

Medicare Part C, also known as Advantage plans, comes with different costs (including deductibles, copayments, or coinsurance), depending on the coverages you need.

You can also always call the professionals at IHS Insurance Group for insights into Medicare’s premium at (866) 480-5063. I H S team has cutting edge quoting software that allows them to see all plans in any geographic location across the country. This gives the team the ability to match you with the right plan at a price your comfortable with.

Related: Medicare Advantage Plan Advantages and Disadvantages

Part D Premium

Your Part D premium will vary by plan and how much money you earned prior to enrolling:

- If your filed income was between $88K (individually) and $176K (jointly), your plan premium will cover your costs.

- If your filed income was between $111K (individually) and $222K (jointly), you’ll pay $12.30 per month, plus your plan’s premium.

- If your filed income was between $138K (individually) and $276K (jointly), you’ll pay 31.80 per month, plus your plan’s premium.

- If your filed income was between $165K and $500K (individually) and between $330K and $750K (jointly) you’ll pay $70.70 per month, plus your plan’s premium.

- If your filed income was above $500K (individually) or $750K (jointly), you’ll pay $77.10 per month, plus your plan’s premium.

Do you still have questions? Call I H S today at: 281 255 4444. One of our team members will be happy to assist you!

As with Parts A and B, you’ll pay a late enrollment penalty if you were without Part D coverage for 63+ days.

Related: Popular Medicare Part D Insurance Providers

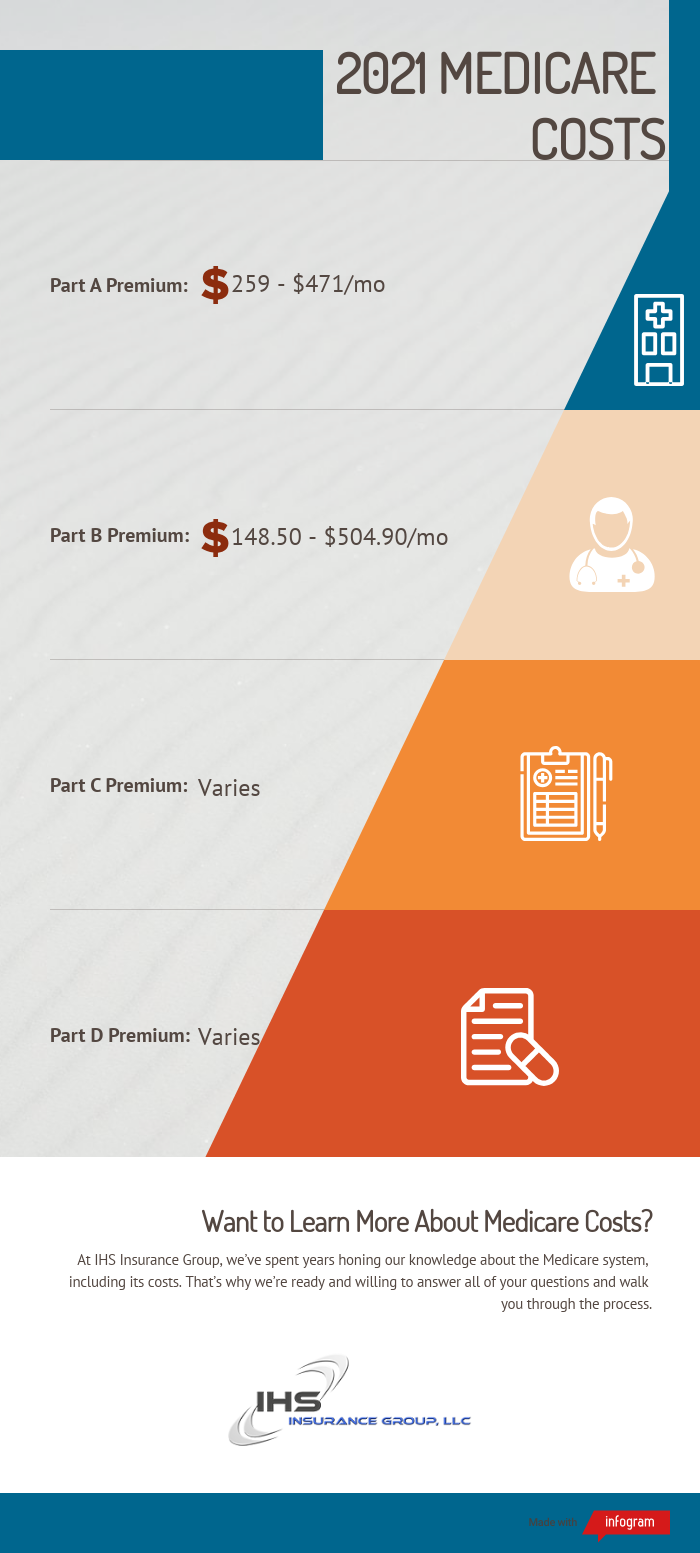

Bringing All of Medicare’s 2021 Costs Together

Here’s a helpful table that brings together all of Medicare’s 2021 core costs:

| Part A Costs | $259 to $471 per month, plus copayments and coinsurance, along with services rendered. |

| Part B Costs | $148.50 to $504.90 per month, depending on your income prior to enrolling. |

| Part C Costs | Costs vary by plan and provider. |

| Part D Costs | If purchased through an Advantage plan, your costs will vary by plan and provider. |

Need to Know More About Medicare’s Costs for 2021?

At IHS Insurance Group, we’ve spent years honing our knowledge about the Medicare system, including its costs. That’s why we’re ready and willing to answer all of your questions and walk you through the process.

Need a FREE Quote or have questions regarding Medicare Coverage? We have three convenient ways to reach us:

- If you prefer to talk to a licensed agent directly, please call (866) 480 5063.

- If you prefer to fill out a quick form and have an agent get back to you at your convenience, use the GET A FREE QUOTE.

- Lastly, for those that want an immediate quote, please click HERE.

Also, check out our Medicare FAQs here.